Saving money is a crucial aspect of financial stability and allows you to achieve your goals, prepare for emergencies, and secure your future. In this comprehensive guide, we'll explore various strategies and tools to help you grow your savings and make the most of your hard-earned money.

High-Interest Savings Accounts: A Reliable Option

High-interest savings accounts (HISA) are a popular choice for many Canadians looking to earn more on their funds. These accounts typically offer higher interest rates compared to traditional savings accounts, allowing your money to grow faster.

Benefits of High-Interest Savings Accounts

- Higher returns: The primary advantage of a HISA is the potential for higher returns. While traditional savings accounts might offer interest rates as low as 1%, a HISA can provide rates of 3% or more, depending on the institution and market conditions.

- Liquidity: HISAs allow you to access your funds whenever you need them. This makes them an excellent option for emergency funds or short-term financial goals.

- No fees: Many HISAs come with no monthly fees, allowing you to keep all the interest you earn. Be sure to read the fine print, as some accounts may have conditions that could lead to fees.

When selecting a HISA, look for accounts with no monthly fees, low minimum balances, and competitive interest rates. Online banks often offer better rates than traditional brick-and-mortar banks, so it’s worth shopping around.

Guaranteed Investment Certificates (GICs): A Secure Path to Growth

Guaranteed Investment Certificates (GICs) are another excellent option for growing your savings. GICs offer a fixed interest rate for a specified term, ensuring a guaranteed return on your investment.

How GICs Work

When you purchase a GIC, you agree to deposit a certain amount of money for a fixed term, which can range from a few months to several years. In return, the financial institution pays you a predetermined interest rate. At the end of the term, you receive your initial investment plus the interest earned. One of the most trustworthy institutions providing GICs is Innovation Federal Credit Union, which offers a range of GIC options to suit your needs and risk tolerance.

Key Considerations for GICs

- Term length: GICs come in various term lengths, and generally, longer terms offer higher interest rates. However, locking your money away for an extended period means you won’t have access to it until the term ends.

- Interest rates: Compare rates from different financial institutions. Some GICs offer higher rates for larger deposits, while others may provide promotional rates for new customers.

- Access to funds: Some GICs allow for early withdrawal, but this often comes with penalties. If you think you might need access to your money before the term ends, consider a cashable GIC.

Tax-Free Savings Accounts (TFSAs): Tax-Advantaged Growth

Tax-Free Savings Accounts (TFSAs) are a powerful tool for maximizing your savings growth. Contributions to a TFSA are made with after-tax dollars, but the interest, dividends, and capital gains earned within the account are tax-free. This means more of your money can stay in your pocket and continue to grow.

Benefits of TFSAs

- Tax-free growth: The biggest advantage of a TFSA is that you won’t pay taxes on any earnings, which can significantly enhance your long-term savings.

- Flexible withdrawals: You can withdraw money from your TFSA at any time without penalty, and the amount you withdraw can be re-contributed in future years.

- Contribution room: The annual TFSA contribution limit for 2023 is $6,500, and any unused contribution room carries forward to future years. If you've never contributed to a TFSA, you may have significant unused contribution room from previous years, so it's worth checking your limit.

The Power of Compound Interest

Compound interest is the key to accelerating your savings growth. When you earn interest on your principal balance, and then earn interest on the interest, your money grows exponentially over time. The longer you can leave your money to compound, the faster it will grow.

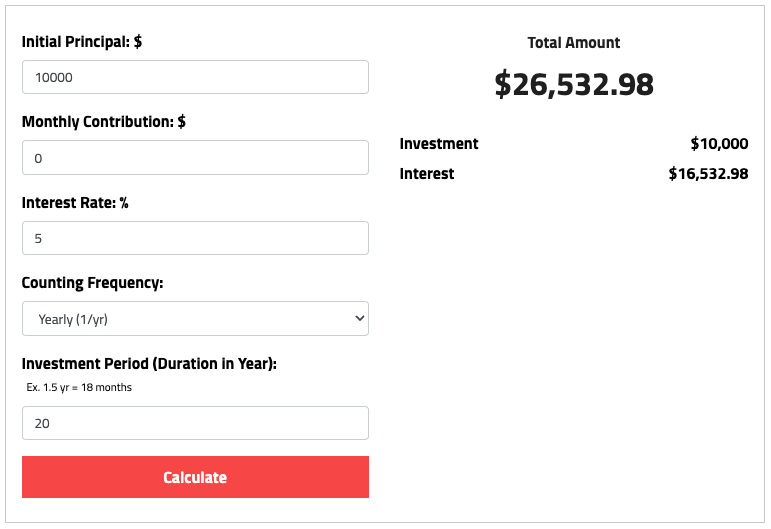

For example, if you invest $10,000 at an annual interest rate of 5%, after one year you'll have $10,500. But if you leave that $10,500 to compound for another year at the same rate, you'll end up with $11,025. You may use our compound interest calculator to visualize your capital gains. Over time, the compounding effect can be significant. To illustrate this further, consider the following:

- After 5 Years: Your initial $10,000 investment at 5% would grow to approximately $12,762.

- After 10 Years: It would reach about $16,288.

- After 20 Years: Your investment would grow to approximately $26,532.

Budgeting and Automating Your Savings

Budgeting and automating your fund preservation are essential for making saving a habit. Start by creating a budget that allocates a portion of your income to savings each month. Many experts recommend the 50/30/20 rule: 50% of your income goes to necessities, 30% to discretionary spending, and 20% to savings and debt repayment.

Steps to Create an Effective Budget

- Track your income and expenses: Begin by tracking your income and expenses for a month to understand your spending habits.

- Set savings goals: Determine what you are saving for — whether it's an emergency fund, a vacation, or a home down payment — and set specific, measurable goals.

- Adjust your spending: Identify areas where you can cut back on discretionary spending to increase your savings.

- Review regularly: Regularly review your budget to ensure you are on track to meet your money preservation goals.

Concluding Remarks

Maximizing your savings is a journey, not a destination. You can take charge of your financial destiny and watch your money increase over time by using high-interest savings accounts, GICs, and TFSAs; comprehending the power of compound interest; and planning and automating your money preservation.

Remember, the key is to start saving today and be consistent in your efforts. With dedication and a little know-how, you can achieve your financial goals and enjoy the peace of mind that comes with a healthy savings account. Your future self will thank you for the smart financial choices you make today!

Share this post

Leave a comment

All comments are moderated. Spammy and bot submitted comments are deleted. Please submit the comments that are helpful to others, and we'll approve your comments. A comment that includes outbound link will only be approved if the content is relevant to the topic, and has some value to our readers.

Comments (0)

No comment